Effective Strategies for Attracting Investors

In the competitive world of business, attracting investors is crucial for growth and success. Whether you are starting a new venture or looking to expand an existing one, securing the right investment can provide the financial boost needed to achieve your goals. This article will guide you through effective strategies for attracting investors, focusing on key investment strategies, how to look for investors, and the best practices for raising capital.

Investment strategies are plans designed to help you achieve specific financial goals. In the context of attracting investors, your strategy should clearly outline how their investment will be used and what returns they can expect. This is crucial because investors want to see a clear path to profitability.

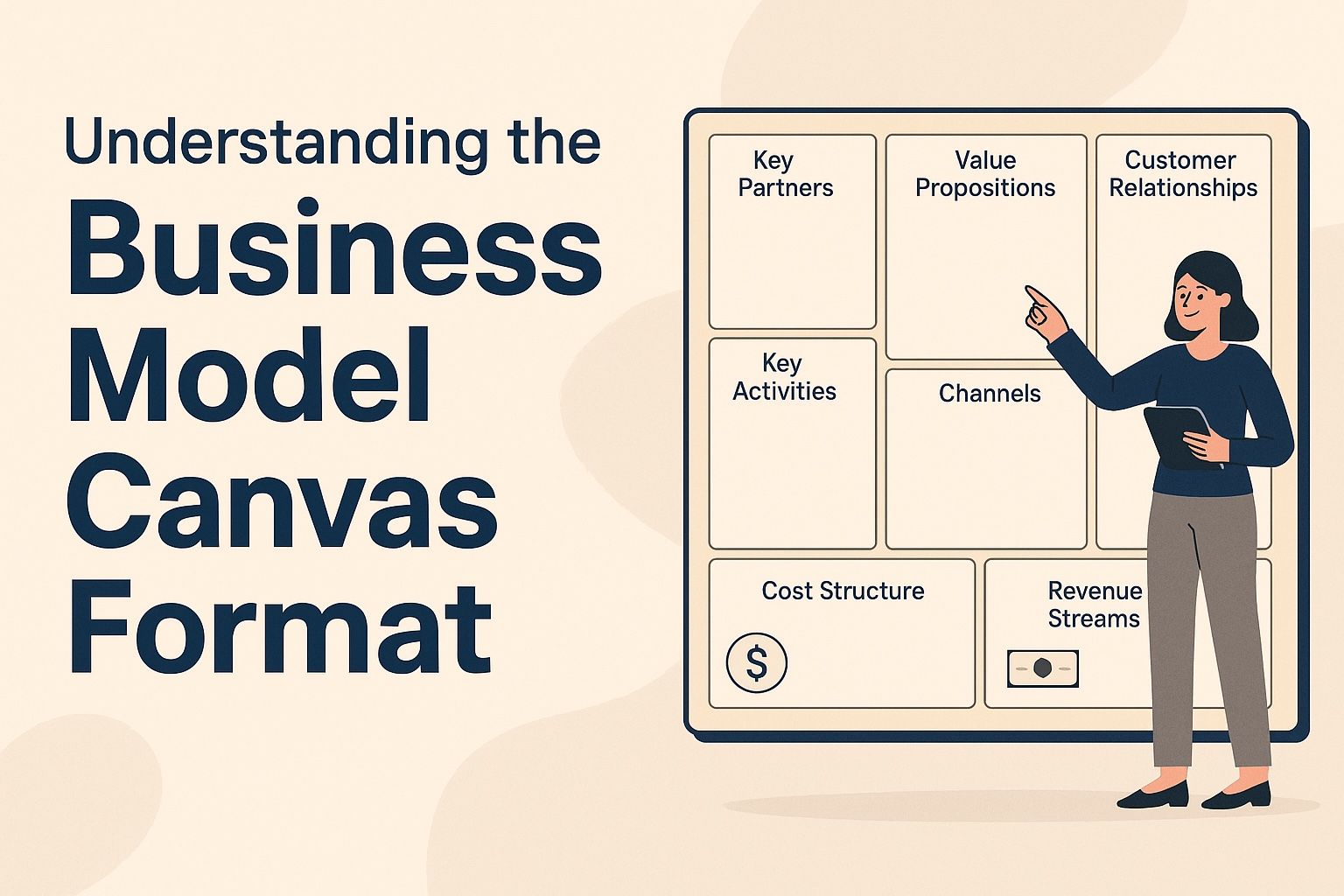

Develop a Strong Business Plan

Your business plan is the foundation of your investment strategy. It should include detailed information about your business model, market analysis, competitive landscape, and financial projections. A well-prepared business plan demonstrates to potential investors that you have thoroughly researched and planned your venture.

Highlight Your Unique Selling Proposition (USP)

Investors are always looking for something that sets a business apart from the competition. Your USP is what makes your business unique and why customers will choose you over others. Clearly articulating your USP in your investment strategy can make your business more attractive to potential investors.

How to Look for Investors

Finding the right investors requires a strategic approach. Here are some steps to guide you:

Network and Build Relationships

Networking is a powerful tool for finding investors. Attend industry events, join business groups, and connect with potential investors on platforms like LinkedIn. Building relationships with key players in your industry can open doors to investment opportunities.

Leverage Online Platforms

There are numerous online platforms where entrepreneurs can connect with potential investors. Websites like AngelList, SeedInvest, and Crowdfunder provide a space for startups to showcase their business and attract investors. These platforms often have a community of investors actively looking for new opportunities.

Engage with Venture Capital Firms

Venture capital firms are investment companies that provide funding to startups with high growth potential. Research and reach out to firms that have previously invested in businesses similar to yours. Tailor your pitch to align with their investment interests.

Utilize Business Incubators and Accelerators

Business incubators and accelerators provide resources and mentorship to startups, often in exchange for equity. These programs can be a great way to gain access to investors and receive valuable advice to refine your business strategy.

Best Practices for Raising Capital

Raising capital is about convincing investors to believe in your vision. Here are some best practices to increase your chances of success:

Create a Compelling Pitch

A compelling pitch is crucial when raising capital. Your pitch should be clear, concise, and captivating. Focus on the problem your business solves, your target market, and how you plan to achieve success. Practice your pitch until you can deliver it confidently and naturally.

Demonstrate Traction

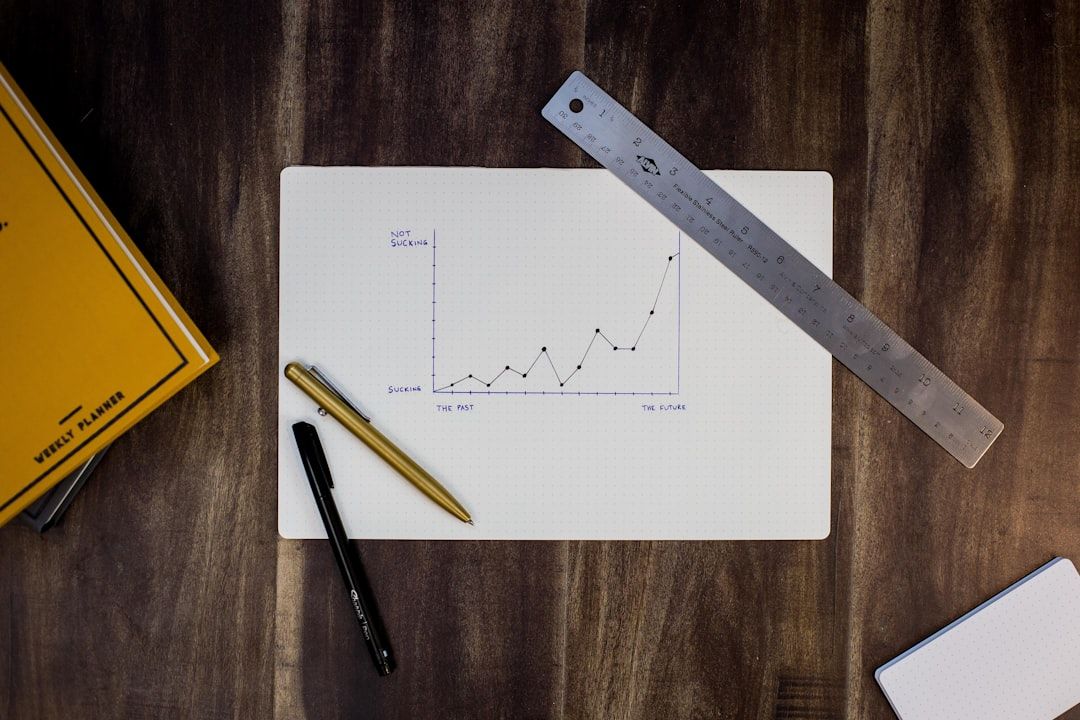

Investors want to see evidence that your business is gaining traction. This could be in the form of sales, user growth, partnerships, or any other metric that shows your business is moving in the right direction. Demonstrating traction can make your business more appealing to potential investors.

Be Transparent and Honest

Transparency is key when dealing with investors. Be honest about the challenges your business faces and how you plan to overcome them. Investors appreciate honesty and are more likely to invest in a business that presents a realistic picture of its prospects.

Offer Clear Terms

When raising capital, it’s important to offer clear terms regarding equity, control, and exit strategies. Investors want to know what they are getting in return for their investment. Clear terms help build trust and facilitate smooth negotiations.

The Role of Market Research

by Isaac Smith (https://unsplash.com/@isaacmsmith)

Market research is a critical component of attracting investors. It provides insights into customer needs, market trends, and competitive dynamics. By conducting thorough market research, you can present a well-rounded view of the opportunity to potential investors.

Identify Market Opportunities

Investors are interested in businesses that can capitalize on market opportunities. Use market research to identify trends and gaps in the market that your business can exploit. This will make your investment proposition more compelling.

Understand Customer Needs

Understanding your customers is key to creating products and services that meet their needs. Use market research to gather insights into customer preferences and behaviors. This information will help you tailor your offerings and demonstrate to investors that you have a deep understanding of your target market.

Conclusion

Attracting investors requires a strategic approach that combines a strong business plan, effective networking, and clear communication. By understanding investment strategies, knowing how to look for investors, and following best practices for raising capital, you can increase your chances of securing the investment you need to grow your business. Remember, investors are looking for opportunities that offer potential for high returns, so make sure to present a compelling case for your business. With the right approach, you can successfully attract investors and take your business to new heights.